When I was young, my parents always stressed how important it was to own your own home. Whilst I’m not here to give out financial advice, this turned out to be good advice for me. I was a 21-year-old engineer straight out of university, having a job and newfound income could have easily led me to make some poor financial decisions. Buying a house for me was like a forced investment with benefits.

I began regularly searching through the real estate websites to understand the market. I made a list of suburbs I wanted to live, and every day I would scour the apps and websites for something that fit within my price range. Back then I didn’t have too many requirements.

- Familiarity – An area that was close to my family and where I grew up

- Nature – I loved the idea of living close to nature and I had always wanted to live close to the water

- Modern Conveniences – I wanted to be close to shops and public transport

- Quiet – I didn’t want to live somewhere too busy

So, in 2011, after months of saving and searching, I discovered a small ex-housing trust property. It was a 2 bedroom, 1 bathroom, semi-detached house built in the late 1970’s. It wasn’t much bigger than a flat or unit.

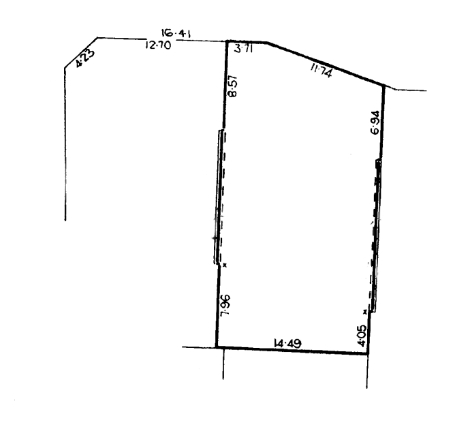

The house was built on a 450m2 irregular shaped plot of land. One side was longer than the other, and the frontage was on an angle to match the street. The front and back garden weren’t small, but they weren’t big either.

All in all, the house wasn’t great, but it was in an amazing location on a nice quiet street and close to the beach. Most importantly, it was in my price range. Without further ado I purchased the house and was now a proud homeowner.

Years went by as I chipped away at the 6-figure negative sum in my bank account. Most of my money went into the home loan and there was never very much left over. For several years, a friend moved in and the house became a bachelor pad. We worked on tearing down much of the front garden, which at this stage was overgrown by weeds.

Not long after, I settled down with my current partner and we overhauled the back garden and put our green thumbs to use. Inside, we ripped up the carpets, repainted the walls and modernised the house to make it more refreshing to live in. We never spent too much on the renovations because in the back of our minds we had other plans. Deep down we knew that we were outgrowing our small home. We began investigating our options – should we buy a new place or knock down the house and rebuild?

Buying a second home and renting out our current one may have been a better long-term investment decision. However, we really loved our neighbourhood. Following the housing market closely confirmed that we were unlikely to find another house in our price range in the same area with all the features we wanted. After years of research, planning and debate, we finally reached the decision to knockdown and rebuild our house.

Our vision for building this house revolved around these key points:

- Social – we love entertaining and being with our friends and family. We wanted a space which allowed people to come together, to interact and have fun.

- Family – we hope to expand our family beyond the two of us, so space to support a family formed part of our decision to build.

- Personal Expression – we both have various interests and wanted to create spaces that effortlessly integrated our hobbies and lifestyle.

- Comfort – we wanted our place to be aesthetically pleasing and comfortable to live in.

- Low Maintenance – we wanted to spend our spare time with family, friends and pursing our interests, which meant designing a house that required minimal cleaning and maintenance.

Thank you for being so open with your experience!

One thought on “Building Our Home – The First Steps”

Comments are closed.

Thank you for being so open with your experience!